geothermal tax credit iowa

Effectively a 52 percent credit based on a formula of 20 of the federal residential energy efficient property tax credit which is 26 for tax years 2020 through 2022. Iowa provides a geothermal heat pump tax credit the 20 credit for Iowa individual income tax liability equal to 20 of the federal residential energy efficient property tax credit allowed for geothermal heat pumps in residential property located in Iowa.

Grain Bin Clearances Southern Iowa Electric Cooperative

Geothermal Tax Credit 2 wwwlegisiowagov Doc ID 1156246 Fiscal Year Tax Credit Redemptions Fiscal Year Tax Credit Redemptions FY 2006 0 FY 2016 0 FY 2007 0 FY 2017 0 FY 2008 0 FY 2018 313195 FY 2009 0 FY 2019 1159339.

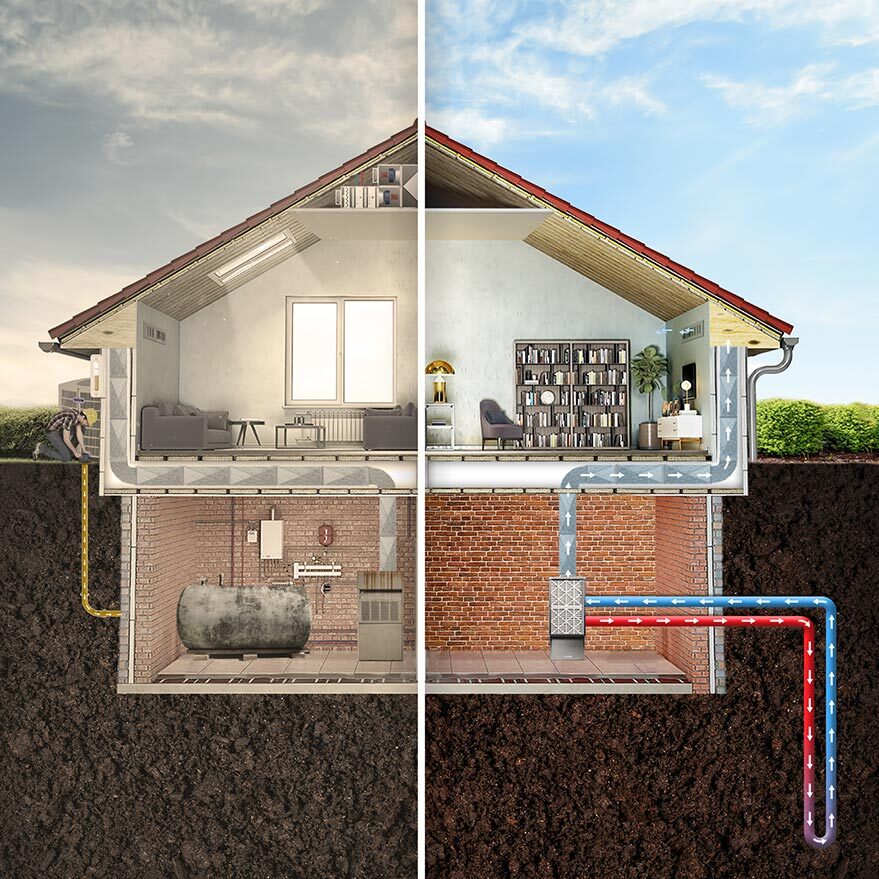

. The credit is available for units installed on or after Jan. Bryan DeJong of Baxter Oil Company Baxter IA and Justin Larsen of Camblin Mechanical Inc Atlantic IAQuick FactsFederal Tax Credit. The tax credit equals 10 of the taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers dwelling or as a thermal energy sink to cool the dwelling.

This new income tax credit replaces previous geothermal-related income tax credits that were repealed by the Iowa legislature effective in 2019. The Credit was available during calendar years CY 2017 and CY 2018 and was repealed January 1 2019. The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through 2022.

November 19 2020 Tax Credit. Residential solar geothermal heat pumps small wind battery storage credit of 30 extended through 2033. We are excited for the clean energy tax credits that will come to Iowa as we continue to invest in renewable energy and the uplifting of environmental justice priorities.

There is also a federal tax credit for as much as 30 percent of the installed costs. Geothermal Tax Credit 2 wwwlegisiowagov Doc ID 1231477 Fiscal Year Tax Credit Redemptions Fiscal Year Tax Credit Redemptions FY 2007 0 FY 2017 0 FY 2008 0 FY 2018 317469 FY 2009 0 FY 2019 1206937 FY 2010 0 FY 2020 277352. November 9 2021 Tax Credit.

Current law allows an individual income tax credit for a GHP system equal to 20 of the federal residential energy efficient property tax credit for GHPs. When multiple housing cooperatives or horizontal property regimes incur expenses that qualify for the tax credit taxpayers owning and living in the units are treated as having made their proportionate share of any qualified geothermal property expenditures made by the cooperative or regime. It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or eliminate what you owe.

Most local utilities offer a handsome incentive for geothermal installationHow it. Geothermal Tax Credit The Geothermal Tax Credit equaled 100 of qualified residential geothermal system installation costs. The equipment must meet the federal energy star.

2017 IA 140 Iowa Geothermal Tax Credit Instructions The Iowa Geothermal Tax Credit equals 10 of taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers residence or as a thermal energy sink to cool the residence. The Geothermal Tax Credit is classified as a non-refundable personal tax credit. Taxpayers filing a claim for the Geothermal Tax Credit were required to submit Form IA 140 in addition to the IA 148 with the individual income tax return.

1 2019 and is available for Iowa homeowners on Iowa residential properties. November 9 2021 Tax Credit. Iowa had a short term program for geothermal and the funding was depleted in short orderOther Local Incentives.

Effective for installations between January 1 2012 and December 31 2016 and for installations after January 1 2019 a Geothermal Heat Pump Tax Credit is available for individual income taxpayers equal to 20 of the federal residential energy efficient property tax credit allowed for geothermal heat pumps provided in section 25Da5 of the Internal Revenue Code for. Taxpayers filing a claim for the Geothermal Tax Credit must submit Form IA 140 in addition to Schedule IA 148 with the individual income tax return. The Iowa Geothermal Tax Credit is.

This rule making implements the Iowa geothermal heat pump income tax credit enacted in 2019 Iowa Acts House File 779 for geothermal heat pumps installed on residential property in Iowa on or after January 1 2019. Ground Floor State Capitol Building Des Moines Iowa 50319 5152813566 Tax Credit. The federal credit is set to expire December 31 2016.

Geothermal energy and batteries across the country including. Lets break down what that means. The Geothermal Heat Pump Tax Credit is available for qualified installations on residential property located in Iowa.

Available to the residentowner of an Iowa residence who installs geothermal at that residence. Iowa community college enrollment. The State credit equals 200 of the federal Residential Energy Efficient Property Credit.

Dawn Pettengill R introduced a bill HF226 in the Iowa House of Representatives to increase an existing state tax incentive for geothermal heat pump GHP installations. For geothermal heat pump units installed on or after January 1 2019. Geothermal Heat Pump Tax Credit 2 wwwlegisiowagov Doc ID 1231475 Fiscal Year Tax Credit Redemptions Fiscal Year Tax Credit Redemptions FY 2007 0 FY 2017 2185938 FY 2008 0 FY 2018 495540 FY 2009 0.

HF226 raises the Iowa credit to 60 of the federal. Geothermal tax credit explained Iowas geothermal heat pump tax credit mentioned in Tuesdays article about state representative candidate Curt Hanson is a residential income tax credit for up to 6 percent of the installed costs. In order to qualify for the Federal Tax Credit you must have some level of.

Its a dollar-for-dollar reduction on the income tax you owe. The tax credit equaled 10 of the taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers dwelling or as a thermal energy sink to cool. Eligible for a new Iowa Geothermal Tax Credit in 2018.

Sustainable Heating Cooling With Geothermal Energy Renew Financial

Geothermal Financing Options And Geothermal Tax Credits

Power Provider Generation Mix Southern Iowa Electric Cooperative

Geothermal Tax Credits Extended Smart Choices

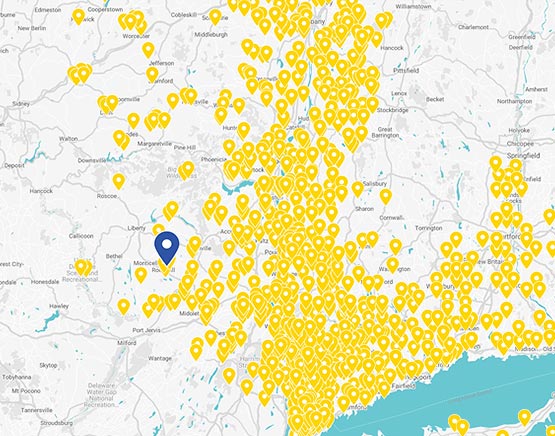

Orange Rockland Dandelion Geothermal Dandelion Energy

How Much Does A Home Geothermal System Cost

Cooperative Solar Western Iowa Power Cooperative

Log Homes With Waterfurnace Geothermal Systems

Orange Rockland Dandelion Geothermal Dandelion Energy

Missouri Energy Tax Credit Rebates Grants For Solar Wind And Geothermal Dasolar Com

Grain Bin Clearances Southern Iowa Electric Cooperative

Orange Rockland Dandelion Geothermal Dandelion Energy

Geothermal Financing Options And Geothermal Tax Credits

Gator Boring And Drilling Services Rock Valley Iowa 712 470 1741

Orange Rockland Dandelion Geothermal Dandelion Energy

How Much Does A Home Geothermal System Cost

How Much Does A Home Geothermal System Cost

Power Provider Generation Mix Southern Iowa Electric Cooperative